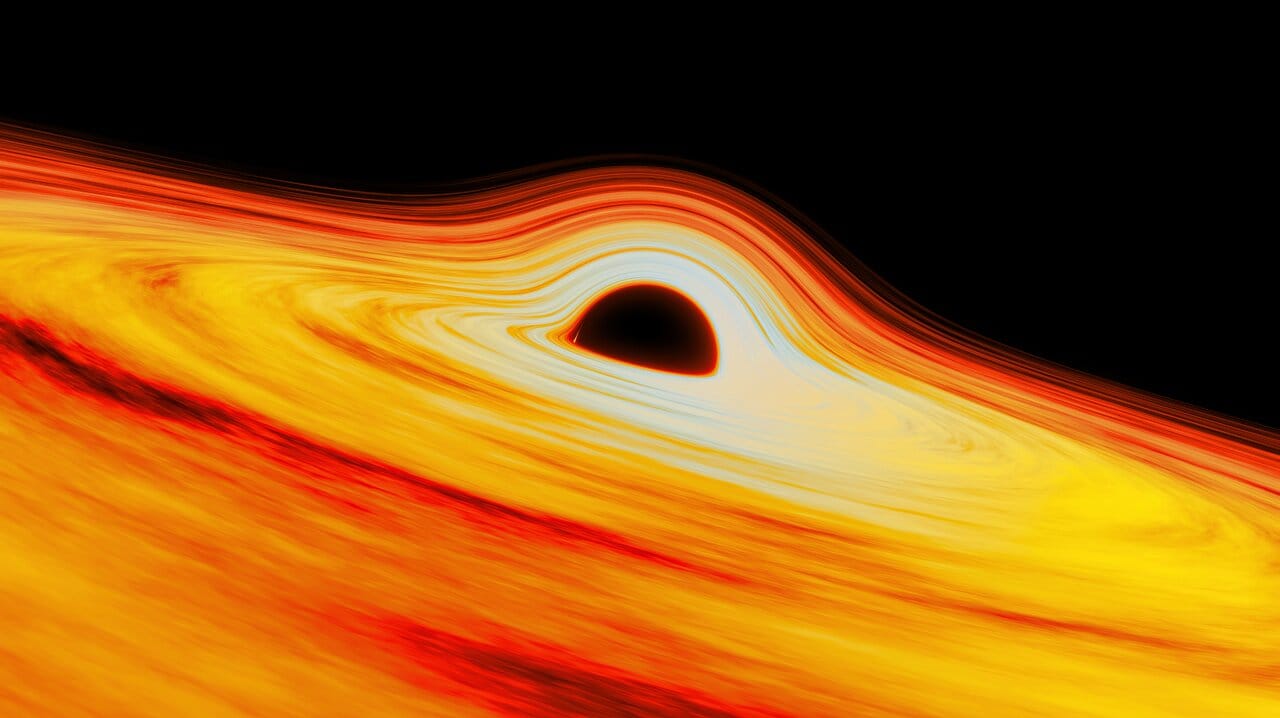

Scientists are searching for signs of a “fifth force” at the center of our galaxy that could rewrite the rules of gravity and help to resolve some fundamental mysteries in the universe, according to a recent study in the journal Astronomy & Astrophysics.

For decades, researchers have speculated that exotic new physics could fill missing links in our current understanding of gravity, which is based on Einstein’s general relativity. One idea is that a hypothetical fifth force—in addition to gravity, electromagnetism, and the strong and weak nuclear forces—known as a Yukawa-type correction might subtly alter how gravity behaves over certain distances. A direct detection of this force could shed light on longstanding puzzles like the nature of dark matter, an unidentified substance that accounts for most mass in the universe, or the behavior of gravity at quantum scales.

Now, researchers have used the advanced GRAVITY instrument at the Very Large Telescope in Chile to look for hints of this correction near the supermassive black hole at the center of the Milky Way.

“The current theory of gravity is unable to explain some observations performed in the universe” such as “the presence of dark matter, or the expanding universe,” said Arianna Foschi, a postdoctoral researcher at the Paris Observatory and an author of the new study, in an email to 404 Media.

“One possible explanation for this may be that the theory of gravity is not complete yet and some modifications to explain those effects are needed,” she added. “We looked exactly for the presence of such a modification.”

Whereas gravity influences objects over massive cosmic distances, the Yukawa correction is predicted to be short-ranged and undetectable in local environments, such as our planet or the solar system. However, hints of this force, if it exists, could be observable near our galaxy’s supermassive black hole, Sagittarius A*, a chaotic region that showcases gravity at an extreme.

With that in mind, the GRAVITY collaboration trained its namesake instrument on a massive star called S2 that is very close to the supermassive black hole, orbiting it once every 16 years. Due to its proximity to the black hole, S2 has yielded many insights about gravity and general relativity, making it an attractive target for the team’s hunt for a fifth force.

The motion of S2, along with other stars around Sagittarius A* “can be incredibly useful to check whether objects orbiting around a supermassive black hole follow the same rule as planets in the solar system,” Foschi said. “Observations suggest that indeed the law that makes S2 move is the same as the Earth, however there still can be modifications that cannot be seen ‘by eye’ but needed to be tested.”

As it turned out, the instrument’s precise measurements did not detect a fifth force, but they did get us closer. The results narrowed down the parameters of its possible intensity, represented by the variable “alpha.”

“If before, alpha must be less than 0.01, now with our data we showed that it must be smaller than 0.003, significantly improving this constraint,” Forschi said.

Lorenzo Iorio, a physicist with the Italian Ministry of Education and Merit and an expert on modified theories of gravity, said in an email that the team’s approach made sense in principle, but that he had some concerns with the methods. Iorio, who was not involved in the study, cited updated formulas and variables that were left out of its models, but that he said might have improved its accuracy. For instance, the models did not account for the Lense-Thirring effect, which is a relativistic phenomenon near massive objects, or the influence of the accelerations of stars near S2, among other factors.

“I'd say that it is an interesting study that, rather, points towards the possibilities offered by this peculiar celestial laboratory (Sagittarius A* and the S stars),” Iorio said. “It should be repeated more accurately.”

Foschi acknowledged that the variables were not included in the models, but noted that the GRAVITY observations were not yet sensitive enough to capture many of those details—yet.

“An upgrade of the GRAVITY instrument is already on its way to increase the sensitivity and measure indeed these higher order effects, but we have to wait for that,” she noted.

“We would like to extend the same analysis to data of other stars around Sagittarius A* and the improving precision of the GRAVITY instrument will help us to do so. In this way we will be able to put on even stronger constraints.”

To that end, the GRAVITY collaboration plans to continue gazing at the center of the galaxy for signs of a fifth force, or any other modifications to gravity.

“If such a force is observed, it would be an incredible breakthrough in physics, because it would modify one of the oldest physical laws we have,” Foschi concluded. “It would have consequences in every field of physics.”

I am talking to Amina, an AI avatar that plays the role of a woman living in a refugee camp in Chad after she escaped violence in Sudan. “I’m hanging in there, yeah,” Amina tells me. “ It’s tough here in the camp, but we’re staying strong.” I ask her how she came to be in a refugee camp. “I fled my hometown of Al Junaynah in Sudan back in June 2023, due to the violence, yeah?” It says. “It was a terrifying journey to escape the conflict. Now I’m trying to keep my kids safe and find some stability here in the camp. It’s not easy but we have to keep going, right?”

One of my conversations with 'Amina.'

Amina is an experiment, part of a pair of AI avatars created by the United Nations University Center for Policy Research (UNU-CPR), a research institution connected to the United Nations. It’s one that is sure to be controversial, considering that the UN itself says a major problem facing refugees is their dehumanization for political gain or convenience. The UNU-CPR project is using an inhuman technology in an attempt to help people learn more about what they are facing. The group also tested a soldier persona called “Abdalla,” which “simulates the behavior and decision-making patterns of an actual combatant, offering negotiators and mediators a possible tool to train for future high-stakes negotiations.”

“The idea was to have independent academic research available to the UN,” Eleanore Fournier-Tombs, a data scientist that leads a research lab at UNU-CPR focusing on AI policy, told 404 Media.

Ask Amina and Ask Abdalla began as a project in an AI for Conflict Prevention class taught by Eduardo Albrecht, a professor at Columbia and a senior fellow at the UNU-CPR. According to Albrecht, he and his students designed the avatars after a classroom discussion about using AI in humanitarian work.

In early tests at a workshop attended by humanitarian organizations, refugee aid groups, and nonprofits, Albrecht and Fournier-Tombs said the reactions were strong and that many were negative. “Why would we want to present refugees as AI creations when there are millions of refugees who can tell their stories as real human beings?” one person said, according to a writeup of the workshop. Another participant worried about “reinforcing biases if interactions with refugees are done with AI agents rather than actual humans,” and that the AI might “sanitize or downplay real human suffering.”

Right now, anyone can test Amina or Abdalla and talk with them for three minutes at a time. “The first is designed to create an accurate digital representation of a refugee living in a camp in Chad. The second creates a digital replica of a combatant leader in the Rapid Support Forces (RSF), a group active in the southeastern part of Sudan from which many refugees are fleeing,” a write up of the project says.

The RSF began as groups of loose-knit militias in the early 2000s before becoming a more formal military group. It’s been conducting ethnic cleansing in Darfur for years now. I asked Abadalla if the RSF is committing genocide, and it gave a generally correct, though vague answer, and not one that you would expect from the group doing the killing.

“The RSF has faced serious allegations of committing atrocities and acts of genocide, particularly in Darfur, including systematic killings, mass rapes, and forced displacement of specific ethnic groups,” Abdalla tells me about the group it’s meant to represent. “These acts reflect a pattern of violence aimed at terrorizing civilians, contributing to the ongoing humanitarian crisis in the region.”

When I spoke with them, both Albrecht and Fournier-Tombs were clear that the goal of the workshop was to spark conversation and deal with the technology now, as it is.

“We’re not proposing these as solutions for the UN, much less UNHCR (United Nations High Commissioner for Refugees). We’re just playing around with the concept,” Albrecht said. “You have to go on a date with someone to know you don’t like ‘em.”

One of my conversations with 'Abdalla.'

Fournier-Tombs said that it’s important for the UN to get a handle on AI and start working through the ethical problems with it. “There’s a lot of pressure everywhere, not just at the UN, to adopt AI systems to become more efficient and do more with less,” she said. “The promise of AI is always that it can save money and help us accomplish the mission…there’s a lot of tricky ethical concerns with that.”

She also said that the UN can’t afford to be reactive when it comes to new technology. “Someone’s going to deploy AI agents in a humanitarian context, and it’s going to be with a company, and there won’t be any real principles or thought, consideration, of what should be done,” she said. “That’s the context we presented the conversation in.”

Albrecht detailed how he and his students constructed Amina and Abdalla in a paper published by the UNU-CPR titled Does the United Nations Need Agents? “Both the Amina and Abdalla avatars were created using HeyGen,” the paper explains. “HeyGen relies on OpenAI’s [GPT-4o mini] to animate the video avatars, and allows for linking via [Retrieval-Augmented Generation] to an external database where the knowledge bases curated by the anthropologist agent are uploaded.”

One of Albrecht’s concerns was accuracy. So he tested it. “This study evaluated Amina’s representativeness using 20 questions drawn from four distinct surveys, none of which were included in her knowledge base: the SENS Nutritional Survey (4 questions), Post-distribution Monitoring Report of Food Assistance in Refugee Camps (3 questions), Norwegian Refugee Council’s ‘War in Sudan’ (8 questions) and UNHCR’s ‘Sudanese Emergency’ (5 questions). 40 Analysis of Amina’s responses revealed that she correctly answered 16 out of 20 questions, achieving an 80 percent accuracy rate.”

“Talking” to Amina and Abdalla is a surreal experience, one anyone can experience by going to the website which Albrecht said will be live for a month after the publication of this article. Their responses feel generic and stilted, as if they were trained on UN reports about the conflict and not interviews with actual refugees. The paper admits that this is a massive limitation of the agents.

“It is impossible to know what information is or is not included in the training data of the LLM since commercial providers do not fully disclose the specific datasets used,” the paper says. “This represents a limitation in the experiment design which should be explored further.”

The paper also speculated how agents like these might one day be used in humanitarian work. “If Amina works, ‘her’ rapid responses could be of great value,” it says. “For example, they could be used to quickly make a case to donors (often in very different locations and with very little time) on what population needs to be prioritized when earmarking aid to the region. If Abdalla works, ‘his’ responses could help negotiators and mediators prepare for more targeted real-world engagement.”

Again, people who attended the UNU-CPR workshop and interacted with Amina pushed back against the idea that AI avatars should be used to communicate with donors. “Participants noted that refugees ‘are very capable of speaking for themselves in real life,’” the paper said.

Albrecht knows that AI systems, especially LLMs, are encoded with the biases of their creators. “Let’s say an NGO is conducting a needs assessment, in part, utilizing these agentic systems. What kind of knowledge would that target population know about how such a system is used? How are they informed? Most importantly, do they have the power to reject or accept the use of these tools and their outcomes?” he said. “Because if you’re making decisions towards a population based, in part, on the outcome of these agentic systems…you’re very directly cutting out the agency of that population you are purporting to help.”

The goal of the experiment, Albrecht said, was always to provoke an emotional reaction and start a conversation about these ethical concerns.

“You create a kind of straw man to see how people attack it and understand its vulnerabilities.”

Last month I put down $100 to pre-order the Trump Organization’s forthcoming mobile phone, the T1. Or, I tried to. As I wrote at the time, the website went to an error page, charged my credit card the wrong amount of $64.70, and sent a confirmation email saying I would receive another confirmation email when my order had been shipped, but I hadn’t provided a shipping address.

I was surprised then to see another two charges on my card from Trump Mobile on Thursday, for $100 and $64.70 respectively. I did not expect or authorize these charges and will be trying to get my money back, if they go through (they’re currently pending). I don’t know when I will get my phone. I also don’t know how to make the charges to my credit card stop because other parts of the (since updated) website also return errors and the customer service number I called on the website couldn’t help either.

At first, the Trump Mobile phone pre-order process was bumbling. The company is now charging my card again and I have no idea why.

Have you ever woken up from a dream you wanted to remember, only to feel it vanish like fog in the morning light? A scene, a feeling, a fleeting glimpse of something otherworldly – gone before you can name it. Dream Recorder was made for that exact fragile moment. Initiated and developed by design and innovation studio Modem in collaboration with creative technologist Mark Hinch, industrial designers Ben Levinas and Joe Tsao, and illustrator Alexis Jamet, this magical, AI-powered bedside device listens as you speak your dream aloud, then transforms it into a short, impressionistic video. It’s a gentle bridge between the subconscious and the waking world, letting you revisit what was once lost to sleep.

It sounds like a dream (no pun intended), but it’s real – and incredibly handy for the wistful waker. Upon waking, press the record button and describe your dream out loud – surreal scenes, cryptic symbols, vivid feelings and all. Dream Recorder’s AI spins your sleepy monologue into a lo-fi, atmospheric video in the visual style of your choice. It’s not a literal replay, but a poetic one: a cinematic dreamscape that mirrors the feeling of dreaming itself.

Instead of scrambling to scribble into a dream journal, you can store a week’s worth of dreams and play them back when you’re ready. It’s dream journaling for the AI age: intuitive, visual, and effortless.

Dream Recorder also respects your rest. Completely standalone and app-free, it keeps your bedroom distraction-free. No buzzes, no notifications. Just a soft glow-in-the-dark shell, waiting patiently for your next subconscious adventure.

The best part about the Dream Recorder is you could get it on your nightstand today if you’re handy with code and electronics – the device is entirely open source. Simply download the code, gather all the off-the-shelf hardware components, 3D print the shell, and assemble using the instructions, all of which can be downloaded on GitHub. There’s no soldering required, making this device a bit less intimidating for those who want to give it a try.

Dreams often hold our brightest ideas, forgotten memories, and unspoken truths. And now, with the Dream Recorder, they become a bit more tangible when we want to remember them most.

To learn more about the Dream Recorder and be on your way to building your own, visit dreamrecorder.ai.

Photography courtesy of Modem.

Most tables for the contract market, while sturdy, are little more than utilitarian pieces with standard finishes. Now Studio TK, in partnership with UK-based company Modus, introduces a fun trio, Modus Art, Arne, and Abe occasional tables crafted from 100% recycled cork.

The tables were designed by Michael Sodeau, who first explored the natural material when he was working on a resort project in Sagres, Portugal. Surprised by its special properties, Sodeau soon realized that cork could enhance pieces made for workplace settings. “Cork isn’t commonly used in contract office furniture,” he says. “I embraced its bulkier nature by creating products that celebrate roundness.”

Cork is a renewable resource, harvested from the outer bark of the Mediterranean cork oak tree without causing harm – a benefit for specifiers who want more sustainable options. The tables are produced with waste materials left over from the manufacturing of wine bottle corks.

Unlike hardwood timbers, which can only be machined, cork is flexible and can be compressed into various shapes, which gives it a dynamic quality. Sodeau decided to highlight this facet by including openings in the furnishings to highlight its texture and imperfections.

In April, Studio TK launched Bob, a cork stool also designed by Sodeau. He tried different shapes, and eventually created a character from the cork with two indents reminiscent of eyes, which also allows anyone to easily pick the piece up and move it anywhere. The stool, and now all of the tables, share similar silhouettes and functions but have distinct design personalities.

Art is the smallest of the three tables, and features an angled cutout that is ideal for a book, papers, or small items. The medium-sized Abe has a lower shelf that runs around its entire perimeter. The largest piece, Arne, showcases a concentric cutout on the top that is the perfect space for magazines.

Art, Arne, and Abe can all be grouped together, or simply placed next to sofas or larger tables. This triad complements a range of palettes and textiles, and can enhance any interior, whether contemporary or traditional. Cork is particularly suited to corporate spaces because it is water-repellent, easy to clean, and provides sound insulation. At the end of their lifecycle the tables can be mechanically recycled into new objects, or composted to enrich the soil.

For Sodeau, even though the tables are compact, they are as unique as the individuals who use them every day. “I like how they each have independent, sculptural, and expressive styles,” he notes.

For more information on Modus Art, Arne, and Abe occasional tables, visit studiotk.com.

Photography courtesy of Studio TK.