Click here to go see the bonus panel!

Hovertext:

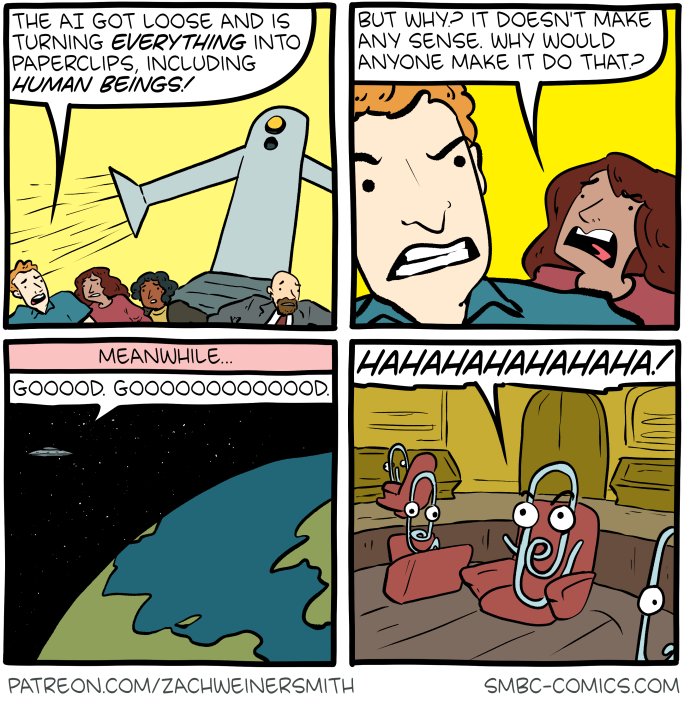

The paperclippification fetishists however are just loving it.

Today's News:

Hovertext:

The paperclippification fetishists however are just loving it.

Hovertext:

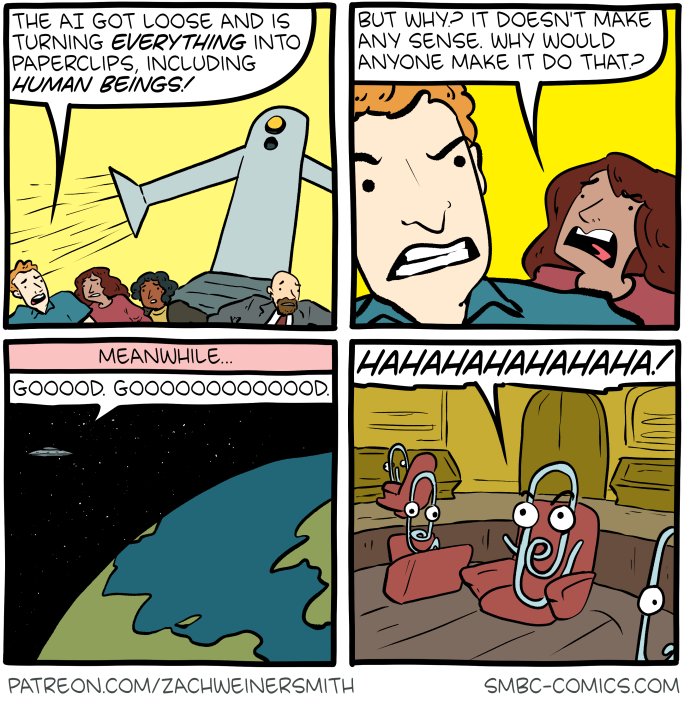

YOU GET OUT OF MY HOUSE BECAUSE I'VE CLEARLY KEPT YOU TOO LONG LET ME CALL YOU A CAB.

Hovertext:

Suddenly wondering if someone has already done this.

Hovertext:

It's not the talking that's so creepy, but the baritone.

Hovertext:

I saw an article that said it was a 3 minute read then offered an AI summary, and I believe it may be included in an eventual epitaph for civilization.